Whether you are buying your first home or purchasing a second home, these glossary of terms can be extremely helpful to all buyers when purchasing real estate. Please don’t hesitate to contact me for further explanation. Need to get in touch with a reputable lender, appraiser, or home stagger? James Jam is eager to refer his resources for the best real estate vendors in town!

GLOSSARY OF TERMS

ADJUSTABLE-RATE MORTGAGE (ARM)

A mortgage where the interest rate is subject to change over the term of the loan as determined by market influences such as interest rates on Treasury securities.

APPRAISAL

An expert judgment or estimate of the value of real estate, made by an appraiser, generally for the purpose of obtaining a real estate loan.

CREDIT APPLICATION

A form used by a lender to obtain personal, financial and credit information to appraise an applicant’s creditworthiness.

DEBT

A specified sum of money that is legally owed from one to another.

DOWN PAYMENT

Amount paid up front when arranging credit, sometimes referred to as cash down.

ESCROW ACCOUNT

Monies collected from the borrower’s installment payments for the purpose of paying property taxes and insurance. An escrow account is typically required when the loan is more than 80% of the property value.

INSTALLMENT LOAN

Debt borrowed for a specific purpose such as automobiles or real estate. The debt is paid in regularly scheduled installments over a specified period of time. The account is closed when the debt is paid.

LOAN ORIGINATION FEE

The fee lenders charge for making a loan. Example: 1% for a $100,000 mortgage equals a $1,000 loan origination fee.

PITI

Refers to the combined monthly amount of “principal, interest, taxes, and insurance” paid in the financing of real estate.

PROPERTY TAXES

The annual real estate taxes charged to property owners based on the assessed value of the property.

ADJUSTABLE-RATE MORTGAGE (ARM)

A mortgage where the interest rate is subject to change over the term of the loan as determined by market influences such as interest rates on Treasury securities.

BALLOON LOAN

An amortized loan calling for one large payment for the remaining amount due at a specified time during the amortized period.

CREDIT REPORT

Also known as consumer credit information, the report contains information about a consumer’s identity, credit relationships, any court actions, consumer statements, and previous inquiries into that file.

DEBT-TO-INCOME RATIO

The ratio of a borrower’s monthly payment obligation on long-term debt divided by the monthly income.

EQUITY

The financial difference between the current market value and the amount owed.

FIXED RATE

A rate of interest charged for credit that does not change over the life of the loan.

INTEREST

The charge for the use or loan of money, typically expressed as a percentage. The interest rate remains constant in a fixed-rate mortgage.

MARKET VALUE

The worth of something determined by a willing buyer and seller in an open market. Market value can fluctuate depending on supply and demand, and other market forces.

PRINCIPAL

The original balance of money loaned. As the loan is paid over time, the principal is the remaining loan balance.

REVOLVING DEBT

Debt on an account that the borrower can repeatedly use and pay back without having to reapply every time credit is used (such as credit cards).

ANNUAL PERCENTAGE RATE (APR)

A measure of how much interest credit will cost, expressed as an annual percentage.

CLOSING COSTS

All fees and charges paid at closing for services including the lender or mortgage broker, and certain other fees paid to third parties for services that the lender requires the borrower to purchase.

CREDIT SCORE

A number, typically between 330 and 830, that lets lenders and others determine how likely someone is to pay loans and credit cards.

DISCOUNT POINTS

A lump sum paid to the buyer’s creditors to reduce the cost of the loan. This payment can either be required by the creditor or volunteered by the seller in a loan to buy real estate.

ESCROW

Property or money held by a third party until the agreed-upon obligations of a contract are met.

FORECLOSURE

The legal action of the lender to take back possession of any property used to secure repayment of the loan when the debtor fails to meet the payment obligations.

LIEN

Legal document used to create a security interest in another’s property. A lien is often given as a security for the payment of debt. A lien can also be placed against a consumer for failure to pay what is owed.

MORTGAGE

A written agreement to repay a loan. The mortgage serves as proof of an indebtedness and states the manner in which it shall be paid.

PRIVATE MORTGAGE INSURANCE (PMI)

Loans with smaller down payments involve greater risk for the lender, who requires protection in case the loan goes into foreclosure. Anything less than 20% down payment usually requires PMI.

TERM

The length of time the borrower has to pay back a loan.

Weekly Real Estate Market Update for Carlsbad Homes & Popular Nearby Neighborhoods

Single Family Homes Market Update

- Encinitas Real Estate

- Carlsbad Beach Homes (92008)

- Carlsbad, CA 92009 Real Estate

- Carlsbad, CA 92010 Homes

- Carlsbad, CA 92011 Real Estate

Condos & Townhomes Market Update

FIND YOUR DREAM HOME TODAY!

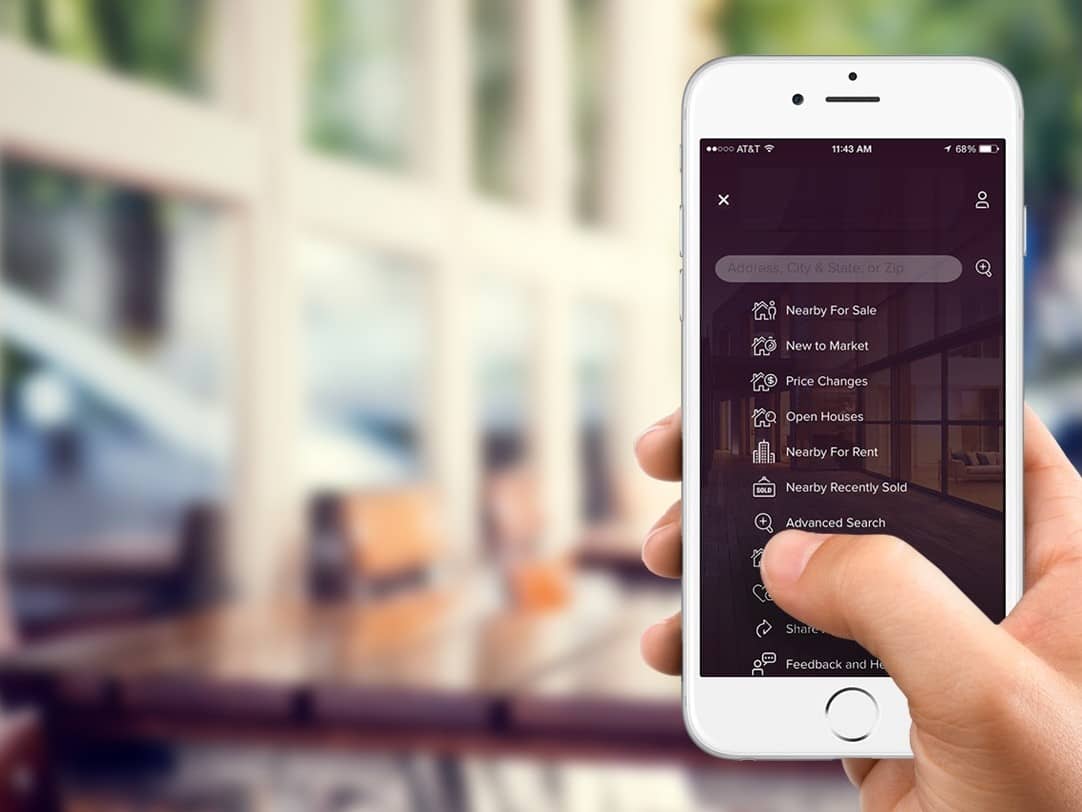

MOBILE APP

With our custom mobile app, you can instantly search for new property listings anywhere, anytime, from any device. Mobile and tablet use is on the rise, and our responsive design ensures that you see stunning properties on every platform. Available on iOS and Android.

DIGITAL COMMUNICATIONS

E-Newsletter – Offering carefully curated featured listings, buying and selling advice, the latest in home trends, and more.

Open House Alters – Receive a weekly alert detailing upcoming open houses in the most desirable neighborhoods.