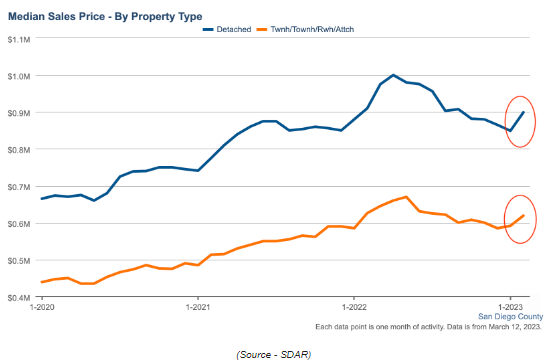

Is it possible to have continuing higher mortgage rates and higher home prices?

The answer is YES, but only in the short run.

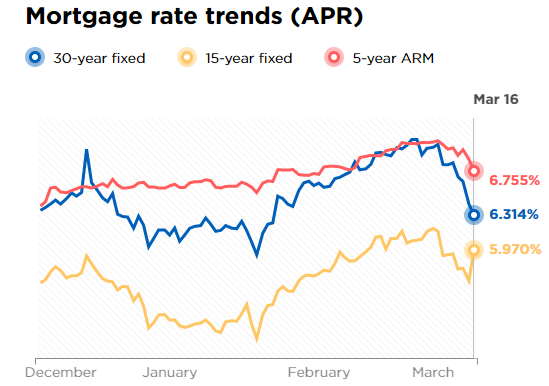

With mortgage interest rates up over a full percentage point in less than a month and standing at 7%, in early March, you would think the housing market in San Diego would be facing a downturn.

That hasn’t been the case recently, for the following reasons:

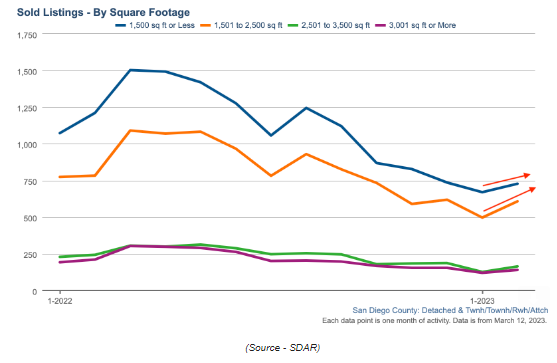

Inventory levels continue to stay low at the time of year when buyer activity is reaching its peak, and with spring just around the corner, things should heat up even more. So the imbalance between supply and demand is still pretty much in place. There are many cash buyers eager to buy, and those who still need financing are willing to make the commitment to buying a home despite higher interest rates, even if they have to adjust their expectations. They do that by settling for a smaller home or buying a home that needs some remodeling.

It is true, San Diego has been faring better than most other areas like San Francisco, where you still see an exodus of high-tech employees leaving – some arriving in San Diego and calling it home.

Many who left California (and San Diego in particular), are finding that there is no better place to live and are returning, while other hot markets of the COVID period are cooling off.

The recent run on the banks has also lessened the probability of the FED raising interest rates as much as earlier anticipated, causing mortgage interest rates to drop nearly a point in the last few days.

All indications point to a busy selling season already in progress.